does tennessee have inheritance tax

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. What is the state of Tennessee inheritance tax rate.

State Estate And Inheritance Taxes Itep

Tennessee does not have an inheritance tax either.

. For deaths occurring in 2016 or later you do not need to worry about Tennessee inheritance tax at all. IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident. Even though this is good news its not really that surprising.

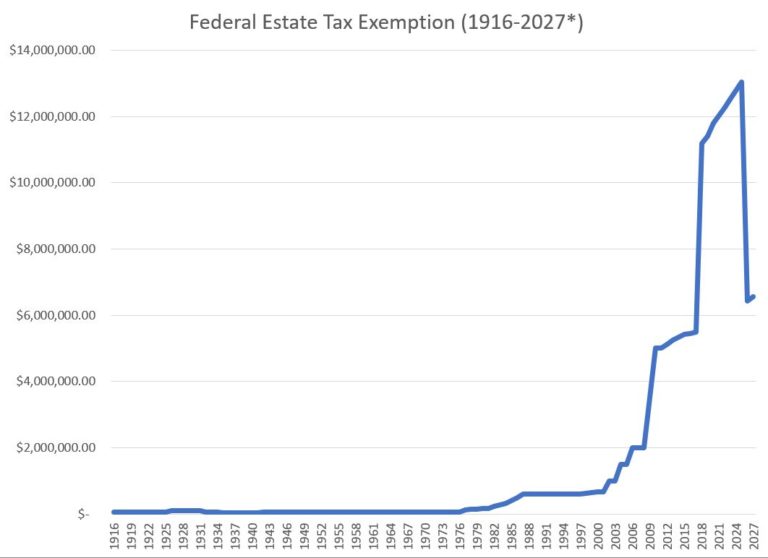

However if the value of the estate is over the exempted allowance for a particular year the tax rate ranges from 55 at the lowest end to 95 at its highest end. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. Inheritance Tax in Tennessee.

It has no inheritance tax nor does it have a gift tax. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. All inheritance are exempt in the State of Tennessee.

IT-12 - Inheritance Tax Deduction - Real Property Sale Expenses. IT-15 - Inheritance Tax Exemption for. Tennessee does not have an estate tax.

It is one of 38 states with no estate tax. IT-11 - Inheritance Tax Deductions. However it does have an estate tax.

For all other estates subject to the inheritance tax for deaths that occurred before December 31 2015 the inheritance tax is paid by the executor. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. For example if a Tennessee resident receives in Heritance from someone who. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

Up to 25 cash back Update. Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now. As of December 31 2015 the inheritance tax was eliminated in Tennessee.

The tax rate varies depending on the relationship of the heir to the decedent. In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of several years. The following is a description of how the tax worked for deaths that occurred prior to 2016.

Only seven states impose and inheritance tax. Ad Download Or Email TN INH 302 More Fillable Forms Try for Free Now. Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015.

There are NO Tennessee Inheritance Tax. The Federal estate tax only affects02 of Estates. The inheritance and estate taxes wont be a concern of Tennessee residents who dont own or inherit the estate in other states or whose estate does not go anywhere around the lifetime exemption of 1206.

For 2021 the exemption in set at 117 million per individual and it is set to increase in 2022 to probably close to 12 million. However if the value of the estate is over the exempted allowance for a particular year the tax rate ranges from 55 at the lowest end to 95 at its highest end. What is the state of Tennessee inheritance tax rate.

The inheritance tax is levied on an estate when a person passes away. It allows every Tennessee resident to reduce the taxable part of their estate gifting it away to the heirs 16000 per person every year. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger.

It is possible though for Tennessee residence to be subject to an inheritance tax in another state. What Other Taxes Must be Paid. How much is tax free inheritance in Tennessee.

IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident. The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is. Until this estate tax is phased out the minimum tax rate for estates larger than the exemption amount is 55 and the maximum remains 95.

For any decedents who passed away after January 1 2016 the inheritance tax no longer applies to their estates. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Last Will And Testament

Is There A Federal Inheritance Tax Legalzoom

Mcleod County Minnesota Treasurers Office Tax Receipts From 1873 1939 John Dvorak 160 Pcs

Calculating Inheritance Tax Laws Com

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

Spacemaster Transforming X Coffee And Dining Table 2 0 In Walnut Finish

A J Green House In Nolensville Tn Watercolor And Gouache Ousley Chris Art Original Fine Art Fine Art

What Are Estate Taxes And How Will They Affect Me Wallstreet Siteonwp Cloud

State Death Tax Is A Killer The Heritage Foundation

Colorado Springs Colorado Springs Colorado Vacation Destinations

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Tax Burden By State 2022 State And Local Taxes Tax Foundation

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Market Inheritance Tax Retirement Strategies Tax

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)